On Isleta Pueblo

Tools & Resources

Native American Homeownership Program

-

-

- 100% Financing Based on Appraisal Value

- 15 to 30 Year Term

- Fixed Interest Rate

- No Mortgage Insurance Premium

- One-Time Construction Close for New Construction

- Closing Costs & Down Payment Included in Loan – Grants Available

- Applicants must be members of a Federally Recognized Tribe – Proof of Tribal ID or Certificate of Indian Blood must be provided

-

Tiwa Lending Services (TLS) offers competitive rates. Loans will be provided at the last published interest rate set monthly by a 30-year Treasury bond rate plus .375%, servicing fee, plus 1.00%. A borrower may buy-down their interest rate. The interest rate will lock-in on the closing date. The 30-year Treasury bond rate may be found here.

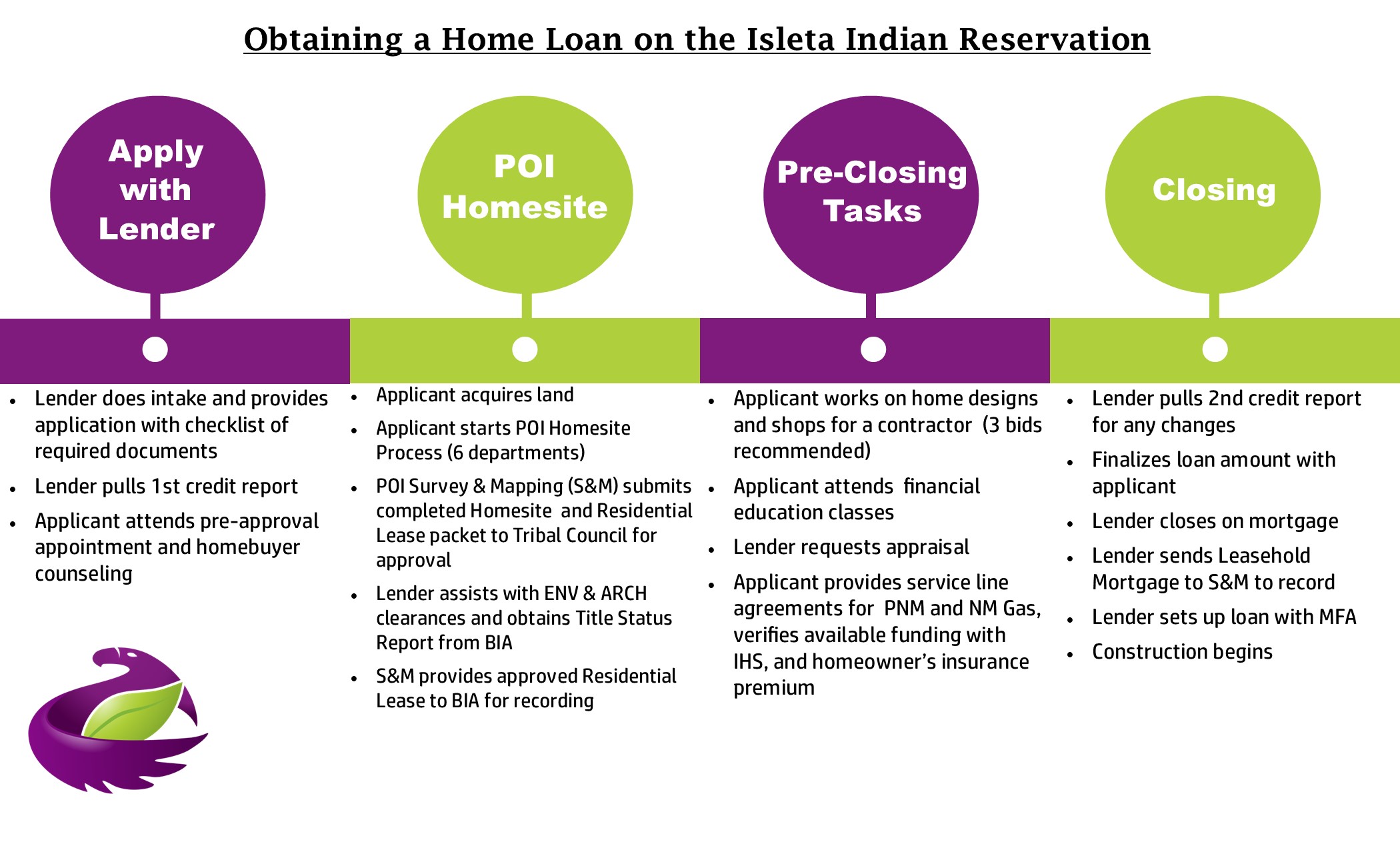

I. Loan Application Process

If funding available, TLS will contact applicant.

-

- TLS determines whether applicant meets eligibility requirements.

- Applicant obtains all necessary documentation (e.g., purchase agreements, building contracts with licensed contractors)

- If Home Loan Program funds are inadequate to fund loan amount, applicant will be placed on a waiting list.

- If funding available – TLS will contact applicant to complete loan origination process to determine credit worthiness.

- TLS appraises value of home or designs to determine value of home.

- Amount of home loan is determined by TLS based on credit worthiness and appraisal of home.

- Loan closing – promissory note, mortgage and other loan documents are signed.

II. Pueblo of Isleta Home Site Development Application

-

- After TLS home loan pre-approval is complete, the applicant may be required by Pueblo of Isleta to start the Home Site Development application.

III. Residential Lease Process

-

- Applicant must have a land assignment (Must have a legal description of the land and a survey. May obtain from Isleta Realty Department.). TLS will assist with this process.

- Obtain a Residential Lease from Tribal Council. TLS will prepare the Residential lease and submit to the Tribal Council for approval.

- Record residential lease with BIA and Isleta Realty Department.

TLS will perform functions described in 2, 3, and 4.

IV. Mortgage of Residential Lease

-

- Request Title Status Report (TSR) from BIA and confirmation from the Isleta Realty Department and the Isleta Tribal Courts that there are no disputes on the land. TLS will assist with this process.

- Execute promissory note, mortgage of residential lease and other loan documents to close the loan.

- Record mortgage of residential lease with BIA and Isleta Realty Department.

TLS will perform functions described in 1,3, and 4.

V. Funds for Disbursement of Home Loan

After loan closing:

-

- Loan proceeds for purchase of a home are paid to seller, or

- Loan proceeds for construction or renovation are placed in TLS’s lending account and drawn upon as work on the home is completed.

VI. Payments

Borrower makes monthly payments on the loan for 15-30 years, depending on the loan amount.

A copy of the Program Policies may be obtained from TLS.

Additional Home Loan Eligibility Requirements

-

- Must not have previously obtained a home loan from either the Pueblo or TLS

- Unless the home is located within the village proper, the home must be the principal residence of the borrower for at least five years from the loan closing date.

- If the loan is for the purchase or construction of a home within the village proper, the applicant must not already own a home in the village proper.